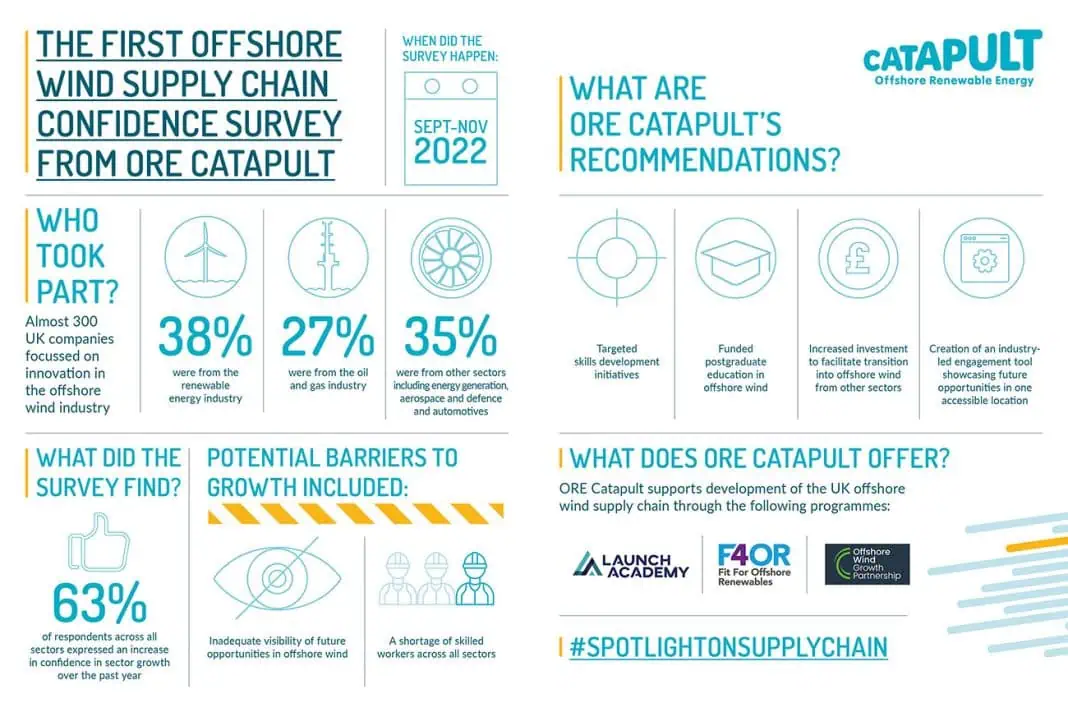

A survey from the Offshore Renewable Energy (ORE) Catapult reveals a high degree of confidence in future growth but highlights challenges in areas of skills and visibility of opportunities.

The first in depth survey into the confidence of the UK Offshore Wind supply chain has revealed an optimistic outlook in the sector despite the challenging economic conditions and highlighted some key challenges it faces if it is to realise its full potential.

The Offshore Wind Supply Chain Confidence Survey, undertaken by ORE Catapult between the end of September and early November to establish a benchmark by which to measure future progress, polled almost 300 UK companies currently focussed on meeting the demands for innovation from the expansion of the UK’s offshore wind industry. Over one third were from the renewable energy industry, 27% from oil and gas and 35% from other sectors such as energy generation, automotive, aerospace and defence, transport and professional services.

63% of respondents across all sectors expressed an increase in confidence over the past year in their growth in the sector, although those from oil and gas were markedly less confident than those in other sectors. This revealed a possible challenge ahead if the UK is to capture the innovation, expertise, and experience from its offshore industries as it continues to develop future green energy supplies.

Commenting on the survey results, ORE Catapult Chief Executive Andrew Jamieson, said,“Innovation throughout our supply chain has been the single biggest driver to date behind the UK’s phenomenal success in delivering affordable, clean energy from offshore wind. The buoyancy of the UK’s supply chain revealed by our survey, despite the current economic challenges, is hugely encouraging and provides a high degree of confidence that we will continue to see tremendous economic and job growth from technology and process innovation in offshore wind.”

The biggest challenge to growth identified in the survey is recruitment and retention. The requirement for specific technical expertise and experience, combined with the rapid growth of the renewables industry, is resulting in extremely high demand for key skilled workers, meaning firms face significant challenges in recruiting for such capabilities. This is as true in oil and gas as it is in renewables, highlighting that, whilst a just transition from one to the other is possible in the longer term, it may prove more challenging in the short to medium term.

A further challenge identified is visibility of market opportunities. Companies from all sectors indicated that they want enhanced visibility of relevant future opportunities in offshore wind and feel that they would benefit from improved information available to them regarding market requirements for entering the offshore wind industry.

Melanie Onn, Deputy Chief Executive of RenewableUK said:“This survey highlights a strong sense of confidence among supply chain companies in the clean energy sector that they will continue to expand as the market grows even larger. We can help those companies by intensifying our work to reach out to them proactively, flagging up further opportunities to win new contracts, as well as encouraging new firms to enter our sector. The industry is also determined to maximise the number of high-quality jobs we’re creating right across the sector by ensuring that excellent training opportunities are in place for roles at every level.”

Enabling recommendations:

Skills

Our survey has identified a need to attract more skilled people at all levels into the sector to realise the tremendous pipeline ambition in the UK. As a result of this, and in recognition of the similar crunches faced in adjacent sectors like Oil and Gas, Offshore Wind needs targeted skills development initiatives, aiming to address gaps in the most pressing area, and should be informed by OWIC and Renewable UK’s valuable Skills and Workforce survey 2023.

Further, enhanced public/private sector sponsorship of targeted Doctoral and Masters programmes in offshore wind can help to address longer-term technical skills gaps. Two such programmes are currently seeking sponsors and applicants through to mid-January:

www.idcore.ac.uk/news/20221027/idcore-now-recruiting-industry-partners-2023

Market visibility and awareness

Further enhancing visibility of market opportunities is a key opportunity to improve market engagement to accelerate the deployment of future offshore wind developments. This should be rapidly addressed to provide greater transparency and supply chain confidence. An industry-led ‘sign-posting and engagement tool’ populated by every project developer, with upcoming procurement opportunities collated in one place, should be established as soon as possible.

Developers and high tier suppliers could further empower supply chain companies to meet market demand through enhanced direct engagement, and not only when Procurement tenders are live, to get across more regular and generic project and industry information, challenges etc.

Increased investment in tailored programmes to facilitate transition into offshore wind from other sectors could include:

- Technology transfer support

- Access to bespoke market intelligence

- Supply chain readiness and procurement advice

These could be delivered through existing ORE Catapult and OWGP initiatives.